Metal is

Super Intelligence for Fundraising

Trusted by veteran founders and investors

Use Cases

Intelligence for every key workflow

in the raise process

Adam uses Metal to identify the "most likely" investors for his round

.png)

Having raised several rounds before, Adam knows his way around navigating venture capital.

Using Metal's deep intelligence capabilities, Adam focuses on investors that have historically seen success in adjacent or similar business models.

Stage:

Seed

Ben uses Metal to gain access to investors

The venture industry runs on warm introductions.

By integrating his Gmail and LinkedIn connections, Ben uses the platform to identify who he knows that can introduce him to specific investors.

Stage:

Seed

James uses Metal to take a more targeted approach

To take a more targeted approach, James uses Metal to identify investors that have done significant work in his space before.

By pursuing strong-fit investors, he is able to transform the type of conversations he's having.

Stage:

Series A

Use Cases

Intelligence for every key workflow

in the raise process

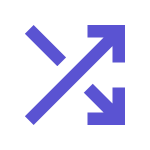

Adam uses Metal to iterate on his pitch deck

.png)

Having raised several rounds before, Adam knows his way around navigating venture capital.

Using Metal's actionable feedback on his pitch deck, Adam is able to iterate his way to improve his deck from a 7/10 score to a 9.5/10, shifting the odds in his favour.

Stage:

Seed

Ben uses Metal to gain access to investors

The venture industry runs on warm introductions.

By integrating his Gmail and LinkedIn connections, Ben uses the platform to identify who he knows that can introduce him to specific investors.

Stage:

Seed

James uses Metal to take a more targeted approach

To take a more targeted approach, James uses Metal to identify investors that have done significant work in his space before.

By pursuing strong-fit investors, he is able to transform the type of conversations he's having.

Stage:

Series A

Join other data-driven founders using Metal's intelligence platform

Creating Access

Leverage Your Network to Identify Intro Paths

Use your existing investors or close contacts to "share" their connections to power your intro pathways

Sort Investors by Availability of Intro Pathways

Limit your search to investors with which you have strong introduction pathways

View Portfolio Founders by Sector & Country

Use granular filters to sort through portfolio founders for specific investors

View Investing Partners by Sector & Country

Seamlessly identify investing partners that are most relevant to your stage, sector and/or geography

.png)

Fundraising Pitfalls

Use AI-driven investor research to

avoid common frustrations

Finding an intro to a potential lead investor and landing that first call only to find out that they are not actively leading rounds.

Spending hours of research just to identify a mutual connection who can make a warm introduction to a given investor.

Jumping into an investor call only to find out that their “sweet spot” is very different from the current stage of your business.

Trying to piece together lists of relevant investors through news articles, generic databases and Google searches.

Not hearing back from a given investor after a call, then researching them to find out they are in a state of hibernation.

Our Blog

Raising capital without the blindfolds

As a first-time founder, I knew two things – I had to learn about fundraising and had to find a way to get to know people who in turn knew the people that invested in startups. I started my fundraise by figuring out the former part first.

Learning the Pre-Seed Dynamic

I started my approach by first digging into Metal’s product documentation and content sections. I first learned the perspective that the pre-seed landscape is unique (given the limited number of investors specialising at this stage). I learned about investor expectations at pre-seed and how to zoom in on the “most likely” investors.

On pitching investors and developing the right collateral, I was lucky and fortunate to have access to terrific mentors within the Telora ecosystem. In that context, I found myself in a unique position whereby I had the guidance and recommendations of mentors that were invested in my success financially and that had traveled the same path before.

Building the Right Pipeline

With access to Metal, I found it particularly straightforward to build out my pipeline. I relied on data to first identify institutional investors that specialised in pre-seed and that were particularly active. Specifically, I used %_Investments_at_Pre-seed for the former, and 12mo_Deal_Count for the latter.

After identifying investors, I spent some time qualifying them through a three-step process. I first evaluated their investments that were most similar to my Company to assess if it was a good fit. This allowed me to eliminate a lot of investors that were focused on deep tech or other niche sectors.

Subsequently, I looked at the geographical breakdown of investors to eliminate ones that weren’t focused on North America. And finally, I looked for investors that had done a lot of work in the “B2B Software” sector.

Through this process, I identified Afore VC that had done a lot of work in the B2B Software space, that was focused on North America, and that was super active in leading pre-seed rounds. I wouldn’t have identified Afore if it weren’t for Metal.

Building Access to the Right Investors

Before starting the raise, I knew I had to connect with people that knew the people that invested in startups. Using the relationship intelligence and intro pathways within Metal, I identified VC-backed founders that I knew that had raised pre-seed rounds.

The Gmail and LinkedIn integrations within Metal were a true game-changer. Through these integrations, I found another Telora company that knew Haven, a startup whose founders were connected with many VCs, including a principal from Afore VC.

In total, I had less than 30 conversations (of which only about 10-15 were calls with investors). By following a super focused approach, I was able to close our pre-seed round within the first four weeks of getting started.

In hindsight, I believe our process and overall raise effort would have been particularly directionless if we weren’t using the right software to identify, qualify and access investors.

Zephyr Technologies is a sports analytics startup that assists sports teams with using statistical insights to drive strategy. With software processes that can find any clip from the game and that can replay specific videos, Zephyr enhances coaching decisions and team performance.

For most sectors, there is a small set of investors that specialises within that space. Such investors are easy to identify by virtue of their historical investing pattern, which shows a large percentage of total investments in a given sector. In the below post, we distinguish between sector familiarity and specialisation (while also explaining how B2B Software is a unique mega sector).

Familiarity vs. Specialisation

Investors that are familiar with a given sector are ones that have made several investments in that space. As an example, investors that have made a minimum of "3" investments in Fintech are familiar with that sector. Such investors can be easily identified using the "Minimum # of Investments in Selected Sectors" filter.

Investors that specialise within a given sector are ones that are concentrating their overall investments portfolio within that space. As an example, investors that have made 10%+ of their total portfolio investments in Fintech are specialising in that space. Such investors can be easily identified using the "Minimum % of Investments in Selected Sectors" filter.

Our product documentation brings further clarity on how to identify and when to pursue investors that specialise in a given sector (versus ones that are familiar with it).

Historically, founders have relied on word of mouth to identify sector specialists. As the venture landscape matures, founders are increasingly relying on empirical data to determine sector specialists. This is best achieved via two distinct methodologies.

Pursuing Sector Specialists

In our conversations with thousands of founders that are actively raising, we observe a pattern whereby founders report high-fidelity and high-context conversations with investors that specialise within their sector. This trend seems to be most prominent with founders that are building in niche sectors (I.e. robotics, productivity software, etc.). Below, we have shared examples of sector specialists that have deep expertise within their spaces:

- Goodwater Capital: With more than 30% investments in Consumer, Goodwater is best known for deep expertise and specialisation within Consumer.

- QED: With over 40%+ investments in Fintech, QED brings deep expertise within Fintech (enabling them to lead 50%+ of all Series A rounds in which they invest).

In most scenarios, founders find it particularly useful to engage with sector specialists that really understand the space and can engage from a position of deep industry knowledge. In some cases, however, it may become critical to pursue sector specialists:

Recommended Treatment for B2B Software

Historical data on venture activity shows that about ~70% of all rounds over the past decade came from companies building in the B2B Software segment. In the realm of B2B SaaS, companies should be able to target a broad variety of investment firms (as most investors are open to investing in B2B SaaS).

Within B2B SaaS, however, there may be specific sub-sectors that require or benefit from sector specialisation. Examples may include enterprise software or productivity software whereby there may be important attributes that are unique to that sub-sector. Therefore, B2B SaaS founders might be best off considering investors that specialise within a given sub-sector.

For most founders, Series A will be the first “priced” round whereby the Company’s valuation is explicitly determined before new investors purchase shares. Most Series A rounds are led by well-known institutional investors that have previously had significant investment experience.

It is commonly believed that the market for Series A financing has been particularly tough after the market downturn of 2022. To challenge this view, several industry observers have explained that the contraction is a “return to the normal” whereby venture activity has returned to the same levels as before the ZIRP eta. Historical data on venture activity corroborates this viewpoint.

Stage Expectations

At Series A, investors evaluate investment opportunities based on growth and traction metrics. Most investors expect a detailed data room that clearly lays out key trends in the financial, growth and traction performance of the Company. The specific nature of the metrics and the content for the data room varies significantly by sector and by business model.

Ultimately, Series A rounds are focused on a compelling forward-looking growth narrative. Historical growth matters to the extent that it can be used as a proxy to project future growth.

At the lower end. SaaS companies have successfully raised Series A rounds with only $0.5-1m in annualized run rate (with 100-150% year-over-year growth). On the upper end, companies have shown $3-3.5m in annualized revenue run rate (with 500%+ year-over-year growth). These benchmarks vary significantly based on business models, sectors and geography.

Stage Objectives

At Series A, companies are raising capital to double down on a validated market opportunity. At this stage, capital is typically deployed to achieve 3-5x revenue growth (over a 12-24 month time-frame).

For operations-heavy businesses, demonstrating the right level of progress on unit economics will be a key objective. For B2B SaaS companies, top-line growth will be a critical evaluation criteria. In most scenarios, founders will want to set measurable objectives for the round that will qualify the Company for the next stage.

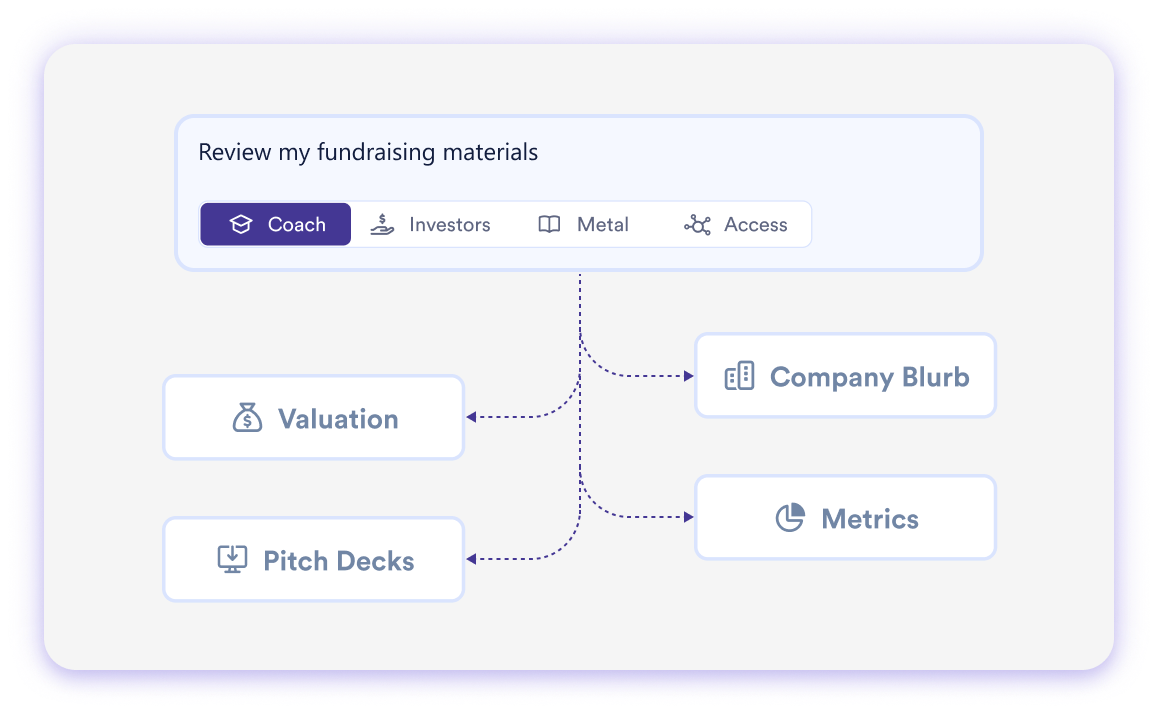

Round Size & Valuations

Based on industry benchmarks and our market research, Series A rounds for B2B SaaS companies in the US range from $5-20m (with the median coalescing around $10m). The below chart from Carta provides an overview of median round sizes from 2020-23:

Valuations and round sizes at Series A have remained fairly consistent in recent years. We do, however, see significant fluctuations across sectors:

Optionality at Series A

At Series A, founders have a lot more optionality than they do at Pre-Seed, but a lot less than at Seed. This is because a fairly limited number of investment firms specialize at Series A. The below chart shows the total number of active investors in the US that specialize at Series A:

The above chart draws on US-based investors that are actively investing, that have made at least 10 lifetime investments, and that have made at least 25% or more of their total investments in the specific stage mentioned above (to qualify as a stage specialist).

Investor Types at Series A

Unlike other rounds, VC firms tend to play a much bigger role at Series A than they do at Pre-Seed or Seed. About 60% of all venture investments at Series A are from VC firms.

Intuitively, the above data makes sense given that round sizes are larger at Series A, requiring a deeper and more nuanced ability to navigate the risk-reward dynamics.

Investors to Target

At Series A, the biggest challenge is to find a lead investor that can then coalesce other investors into the round. Based on data shown above, the number of investors participating in Series A rounds tends to be much larger than those leading.

Founders, therefore, need to start their search with a focus on identifying the right lead investor. For founders, a common pitfall to avoid is the inclination to engage non-lead investors in a Series A process when the Company hasn’t yet secured a lead for the round.

Summary

Series A is different from prior rounds – there is generally less optionality, investors lean in heavily on traction and operating data, and finding a lead is particularly important given the round size. In navigating these dynamics, a strong focus on being super targeted on the “most likely” investors gives founders an important edge.

.svg)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.webp)

.png)

.png)

.png)

.png)

.png)

.png)